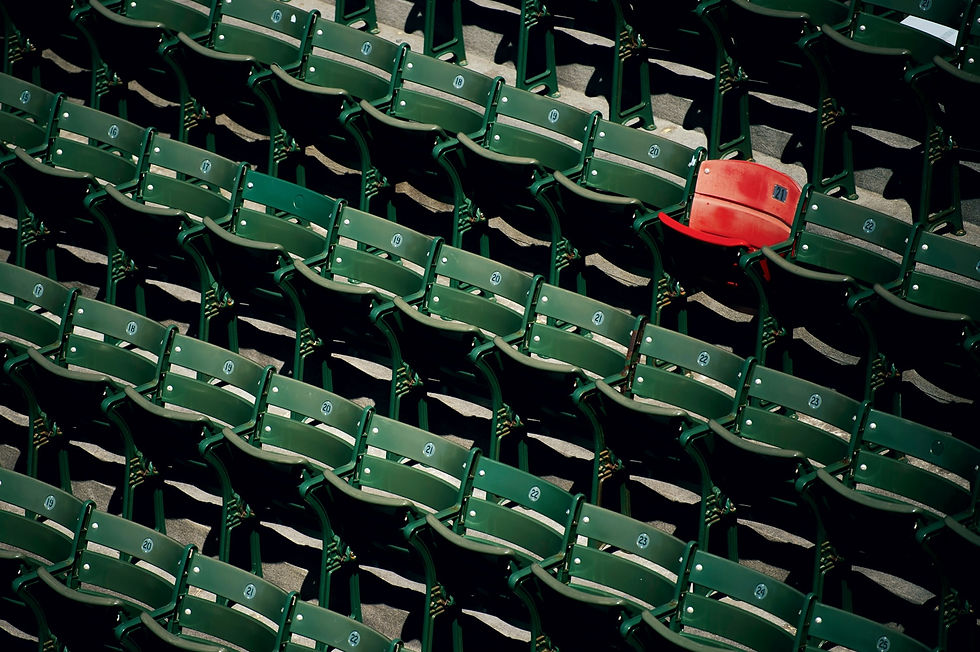

Great Businesses Stand Out From the Crowd

M&A transactions cannot be handled from 30,000 feet.

We roll up our sleeves, working as an extension of the team to guide our clients through every stage of the deal to reach a successful outcome.

Sell-Side M&A Advisory

Selling your business is often a once-in-a-lifetime event and navigating the process can be complex.

Leveraging our private equity background, we understand how buyers evaluate businesses. We use that insight to position your company strategically, anticipate key questions, and proactively address potential concerns — ensuring a smoother, more successful transaction.

Buy-Side M&A Advisory

The key to a successful M&A growth strategy lies in honing in on the right targets that meet your investment criteria and align with your long-term goals for growth. Our buy-side advisory services are tailored to investment firms or industry buyers looking to grow through strategic acquisitions.

We identify potential targets meeting your investment parameters, conduct outreach to owners and support your diligence process. Whether the goal is a new platform or an add-on for an existing investment, we accelerate your deal sourcing efforts.

.jpg)

Sale Readiness Advisory

Selling your business requires more than just a desire to exit — it requires preparation. Many deals falter because the financials or business operations are not ready for a buyer's scrutiny.

We review your financials as an investor would to identify any issues to be addressed before going to market to ensure they can stand up to buyer due diligence.

We work with you to prepare your business for sale, including identifying potential red flags and eliminating obstacles before they arise, so you can move forward with confidence and clarity when it’s time to sell.